The Great Exodus: Why China’s Super-Rich Are Looking to Leave

China’s ultra-wealthy are increasingly exploring opportunities to relocate their wealth, businesses, and even their families abroad. This growing trend, often referred to as “The Great Exodus,” is driven by a combination of domestic economic pressures, tighter regulatory oversight, and shifting global opportunities. As China’s financial landscape evolves, the motivations and implications of this migration have become a topic of global interest.

Key Reasons Behind the Exodus of China's Wealthy

Stricter Regulatory Crackdowns

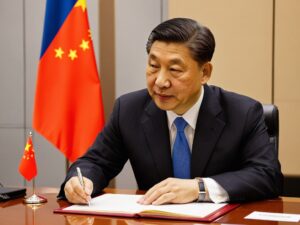

- “Common Prosperity” Campaign: Launched by President Xi Jinping, this initiative aims to reduce wealth inequality by increasing taxes, promoting wealth redistribution, and curbing excesses among the wealthy elite. High-net-worth individuals (HNWIs) face rising financial scrutiny, prompting many to move assets abroad.

- Tech and Business Sector Clamps: Regulatory crackdowns on the technology, private education, and real estate sectors have significantly affected wealth creation. Founders, executives, and investors in these sectors are seeking safer economic environments.

Taxation Reforms and Wealth Levies

- Global Taxation Policy: China is moving toward a global taxation system, where citizens are taxed on their worldwide income, regardless of where they live. This shift has driven the wealthy to explore second citizenships or alternative residency options to protect their wealth.

- Property and Capital Gains Taxes: Speculation around new taxes on real estate and capital gains has created uncertainty. Ultra-wealthy property investors are now looking to diversify their real estate portfolios abroad.

Political and Social Climate

- Political Uncertainty: Changes in government policy and tightening political control have led to growing unease among the wealthy. The removal of business tycoons from high-profile roles and increased state control in private enterprises have eroded confidence in the business environment.

- Social Pressures: China’s wealthiest individuals have become the face of social inequality, making them targets of public criticism. This public sentiment, fueled by state-driven narratives, has prompted many to seek a quieter, more discreet lifestyle abroad.

Education and Family Considerations

- Desire for Global Education: China’s wealthy often prioritize access to top-tier education for their children. Schools in the U.S., U.K., Canada, and Australia offer elite academic opportunities and pathways to permanent residency or citizenship.

- Quality of Life and Freedom: Relocating abroad allows families to access better healthcare, education, and social freedoms. Countries with more relaxed residency or citizenship-by-investment programs have become attractive destinations.

Diversification of Wealth and Risk Mitigation

- Asset Diversification: China’s elite are diversifying their wealth through overseas investments in real estate, stock markets, and alternative assets. Investing in stable foreign markets reduces exposure to China’s economic volatility and regulatory risks.

- Risk of Asset Seizures: With growing state control over private wealth, the super-rich fear the potential seizure of assets. Relocating financial resources to more stable jurisdictions offers peace of mind.

Where Are China’s Wealthy Going?

United States

- Popular Cities: Los Angeles, New York, San Francisco, and Seattle are top destinations for China’s wealthy due to their strong Chinese communities, luxury real estate markets, and elite educational institutions.

- Investment Programs: The U.S. EB-5 visa program, which offers green cards in exchange for significant investments, remains a key route for Chinese HNWIs seeking residency.

Singapore

- Wealth Haven: Singapore’s low-tax regime, political stability, and strategic location in Asia make it a prime destination for Chinese investors and business owners.

- Family Offices: Many Chinese billionaires establish family offices in Singapore to manage global wealth and investments.

Australia and New Zealand

- Lifestyle and Education: Favorable lifestyle, access to elite schools, and investment-friendly visa programs make Australia and New Zealand appealing to Chinese families.

- Investor Visas: Programs like Australia’s Significant Investor Visa (SIV) allow wealthy individuals to gain residency through investments.

United Kingdom

- Luxury Real Estate: London’s luxury property market attracts China’s elite due to its prestige, safety, and access to world-class educational institutions.

- Investor Visas: Although the U.K.’s Tier 1 Investor Visa was discontinued, many Chinese HNWIs continue to explore other routes for residency.

Canada

- Safe Haven: Canada’s clean environment, world-class education, and multicultural society are major draws for wealthy Chinese families.

- Golden Visa Programs: The Quebec Immigrant Investor Program (QIIP) was a popular route, although it is currently suspended. However, wealthy individuals still seek residency through provincial business immigration programs.

How Are They Moving Their Wealth?

Overseas Investments

- Real Estate Purchases: Chinese investors continue to buy luxury properties in major cities worldwide. This not only offers financial security but also serves as a route to citizenship in certain countries.

- Offshore Accounts and Trusts: Wealth is being stored in offshore financial centers, with Singapore, the Cayman Islands, and Switzerland being top choices.

Family Office Setup

- Centralized Wealth Management: Family offices help manage the global wealth of ultra-rich families, offering tax optimization, investment planning, and estate planning services.

- Growing Presence in Singapore: Chinese billionaires are increasingly setting up family offices in Singapore to manage global operations and protect assets.

Residency and Citizenship by Investment (CBI) Programs

- Golden Visas: Countries like Portugal, Spain, and Greece offer residency in exchange for real estate investments.

- CBI Programs: Citizenship-by-investment programs in the Caribbean (e.g., Saint Kitts and Nevis, Dominica) are popular for their simplicity, speed, and global mobility benefits.

Impact on China’s Economy

Capital Outflows

- The exodus of wealth reduces the availability of domestic capital for local investments and economic growth.

- With significant sums leaving China’s financial system, authorities have implemented stricter controls on cross-border transactions and foreign exchange.

Decline in Real Estate and Luxury Demand

- China’s luxury property market may face reduced demand as wealthy individuals invest in real estate abroad.

- The luxury goods and high-end consumption market could also be affected, as HNWIs choose to spend their wealth overseas.

Loss of Talent and Innovation

- Business leaders, entrepreneurs, and skilled workers migrating abroad may reduce domestic innovation and competitiveness.

- This “brain drain” could affect key industries, such as tech and finance, where top executives are relocating abroad.

Tighter Regulatory Measures

- To stem capital flight, China has imposed stricter controls on outbound investments, cross-border money transfers, and foreign currency transactions.

- Companies are now subject to more audits, and individuals face tighter scrutiny when transferring money abroad.

What’s Next for China's Ultra-Rich?

As China’s wealthy elite face increased regulatory scrutiny, higher taxes, and economic uncertainty, many are hedging their bets by securing alternative residences, citizenships, and investment portfolios abroad. While some may return, others are opting for long-term relocation, driving significant change in the global movement of wealth.

The Great Exodus of China’s super-rich highlights the shifting dynamics of wealth preservation, international migration, and global investment strategies. For governments and financial institutions around the world, this represents both an opportunity and a challenge in attracting this mobile wealth.